Auditor General DePasquale Releases Special Report Calling Attention to Potential Lost Revenue from Tax Exempt Properties

Auditor General DePasquale Releases Special Report Calling Attention to Potential Lost Revenue from Tax Exempt Properties

HARRISBURG (Dec. 18, 2014) – Auditor General Eugene DePasquale today released a special report on property tax exemptions that might be costing local municipalities, counties and school districts billions of dollars a year.

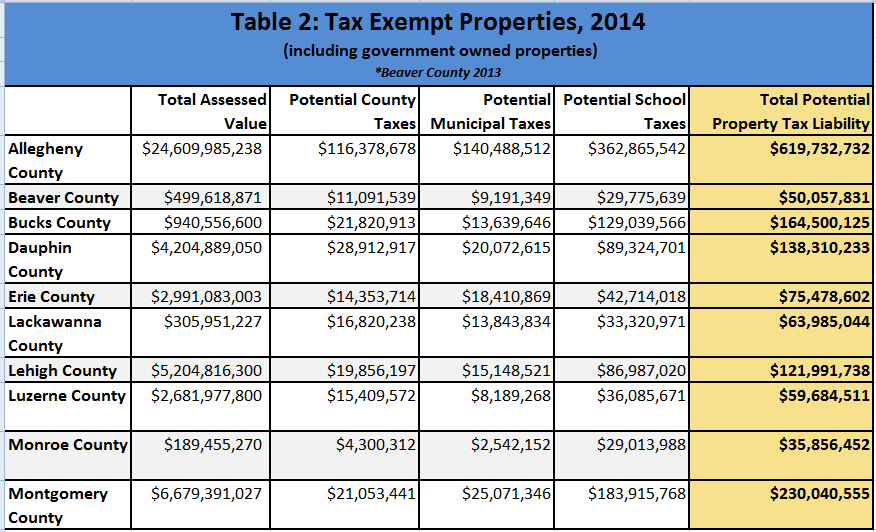

The special report found that more than $1.5 billion in property tax revenue is potentially lost in the 10-county sample examined for the report. Data is included for the following counties: Allegheny, Beaver, Bucks, Dauphin, Erie, Lackawanna, Lehigh, Luzerne, Monroe, and Montgomery. The report reflects potential property tax liability in the county, municipality and school district where each property is located.

“We are at a major crossroads in the decades-long debate over how to define and review the property tax exempt status of nonprofit organizations in Pennsylvania,” DePasquale said, noting that legislation is moving forward that could put a constitutional amendment on the ballot as early as May for voters to decide how charitable entities can gain tax exempt status.

“There is no denying that counties, municipalities, and school districts across the state continue to grapple with mounting financial challenges, while many nonprofits’ charitable work is financially dependent upon their property tax exemption,” DePasquale said. “Before the issue comes to voters I want people to be informed and know how their vote may impact their local community.

“This report should stimulate interest in this important issue that could be put to a public vote shortly after the General Assembly returns to Harrisburg next year,” DePasquale said.

The “Review of Potential Lost Revenue Due to Property Tax Exemptions” report is available online here.

# # #

Return to search results