Auditor General DePasquale, Treasurer Torsella Warn Legislators of Dangerously Low General Fund Balance Going into Next Fiscal Year

Projections call for borrowing up to $3 billion for operational expenses in first eight months of FY 2017-18

Auditor General DePasquale, Treasurer Torsella Warn Legislators of Dangerously Low General Fund Balance Going into Next Fiscal Year

Projections call for borrowing up to $3 billion for operational expenses in first eight months of FY 2017-18

Printer friendly press release

HARRISBURG (June 7, 2017) – The state’s two fiscal watchdogs — Auditor General Eugene DePasquale and Treasurer Joe Torsella — today sent a letter to every member of the General Assembly warning about the dangerously low General Fund balance and growing structural deficit.

Last week the Department of Revenue released May revenue figures showing the fiscal-year-to-date General Fund collections are $1.1 billion, or 3.8 percent, below what was estimated to cover state spending in the current fiscal year budget through June 30.

Text of the letter and accompanying charts are included below.

# # #

June 7, 2017

Dear Senator / Representative:

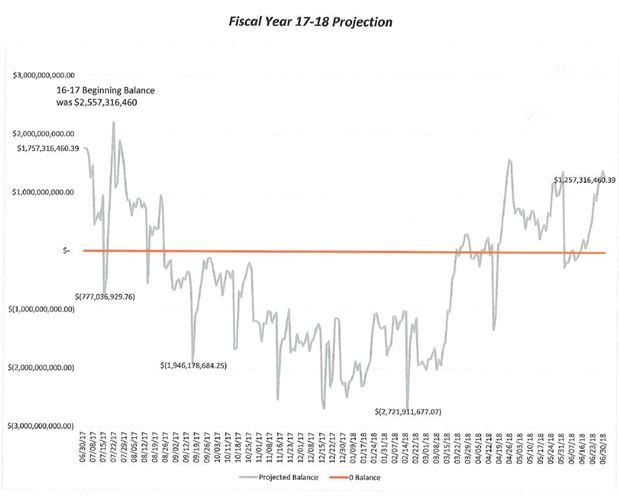

We write to bring to your attention the deteriorating condition of the Commonwealth’s General Fund. As constitutional officers entrusted with the financial oversight of public funds, it is our responsibility to share with you our current projections and concern that the General Fund will post a negative balance for approximately eight continuous months in the next fiscal year. Using historical revenue and expenditure data, we project a need to borrow as much as $3 billion to maintain routine budgeted operations between July 2017 and April 2018. See Chart 1.

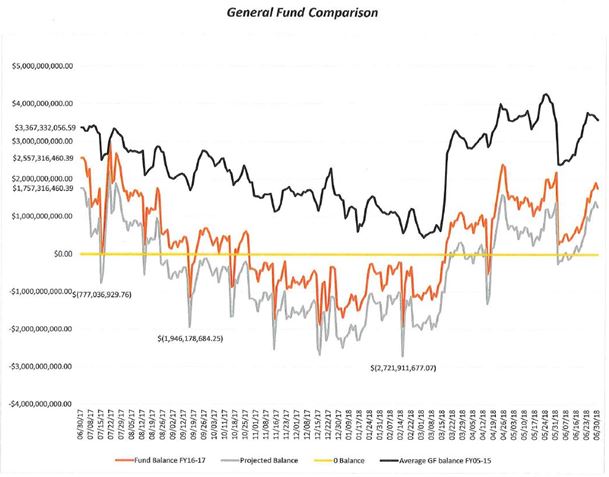

Though short term borrowing to alleviate temporary cash flow needs is not unusual (typically between the months of January and March), Pennsylvania’s cash flow needs are trending from a comparatively manageable amount needed for a few months to a chronic need for billions of dollars. We have documented an annual decline in the average General Fund balance during the last four years, with each year requiring progressively more borrowing over longer periods of time. See Chart 2. For example, the General Fund balance at the start of the current fiscal year was $500 million lower than the start of the prior fiscal year; the starting balance for fiscal year 2017-18 may be additional $850 million lower. See Chart 3.

In recent years, Treasury has been able to mitigate borrowing costs by creating a line of credit from its long-term investment fund (known as a STIP). However, we are concerned that next fiscal year’s borrowing needs may exceed the fund’s lending capacity and compel the Commonwealth to seek more-costly public market alternatives as early as July or August 2017.

To be clear, absent appropriate and significant fiscal changes, Pennsylvania will be paying the bills on borrowed money for most of the 2017-18 fiscal year. The continued drop in the average annual General Fund balance is indicative of a structural imbalance between revenues and expenditures. Without a correction to this imbalance, we anticipate the trend of lower General Fund average balances to continue to worsen in the coming years.

While we remain partners in addressing the Commonwealth’s fiscal challenges, we urge you to take into consideration the increasing financial stress to the General Fund prior to the enactment of the 2017-18 state budget. If interested, you may monitor the daily balance of the General Fund at http://patreasury.gov/. Please do not hesitate to contact either of our offices if you need any additional information.

Sincerely,

Joseph M. Torsella Eugene A. DePasquale

State Treasurer Auditor General