Auditor General DePasquale Discusses Department’s 2017-18 Funding Request with Appropriations Committee

Releases Progress Report highlighting key audits from 2013-2016

Auditor General DePasquale Discusses Department’s 2017-18 Funding Request with Appropriations Committee

Releases Progress Report highlighting key audits from 2013-2016

Printer friendly press release

HARRISBURG (Feb. 22, 2017) – Auditor General Eugene DePasquale today discussed his department’s 2017-18 budget request with members of the Senate appropriations committee. Before taking questions from legislators, DePasquale provided an update on his department’s cost savings initiatives and more than $320 million in potential state savings identified in audits.

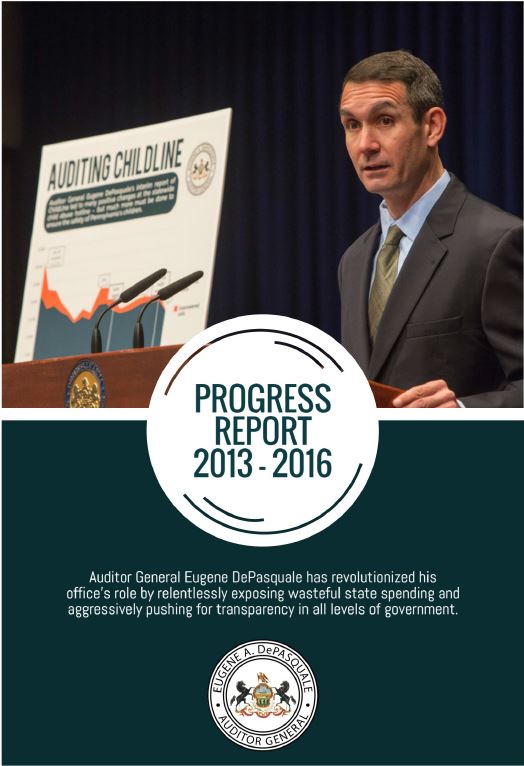

The cost savings are highlighted in a new 18-page “Progress Report” that provides a summary of some of the key audits and special reports his office has produced since 2013.

“During my first four years in office, I worked diligently to revolutionize the office’s role by exposing state spending and aggressively pushing for transparency in all levels of government,” DePasquale said in releasing the report.

He submitted the following statement to the Senate appropriations committee:

Opening Statement of

Auditor General Eugene A. DePasquale

Wednesday, February 22, 2017

Before the Senate Appropriations Committee

The Honorable Pat Browne, Chairman

The Honorable Vince Hughes, Democratic Chairman

Regarding 2017/18 Fiscal Year Budget for the Department of the Auditor General

Chairman Browne, Chairman Hughes, and members of the Senate Appropriations Committee: Good afternoon and thank you for the opportunity to discuss the Department of the Auditor General’s fiscal year 2017-18 budget request.

2017-18 BUDGET REQUEST

The Department requests $44.29 million for the 2017-18 fiscal year. We have worked very hard to keep our request as low as possible. For example, this year, even though we are faced with a more than $2.8 million increase, or 5.47 percent, in costs for contractually mandated salary adjustments, health care and retirement benefits, we only request a modest $890,000, or 2.05 percent, increase in our general government operations allocation for the 2017-18 fiscal year. Since 2013, our mandated benefit costs increased nearly four times more than our budget appropriation. In fact, the total mandated benefit cost increased more than 37 percent since 2013. Despite keeping our complement far below where it was in 2013, personnel expenses now consume more than 95 percent of our budget.

In addition to these mandated cost increases, during the 2016-17 fiscal year, my Department absorbed three employees and major functions of the former Public Employee Retirement Commission (PERC) — which had a separate budget of more than $900,000. We were able to keep our request responsible and realistic because the cost savings we have achieved since I took office have been reallocated to help offset rising mandatory costs.

COST SAVINGS: LEADING BY EXAMPLE

Since we clearly face another very tough budget, I realize that across state government we must continue to improve efficiencies so that we can do more with less. At the Department of the Auditor General, we are doing just that. Given the value that our audits bring to the commonwealth, we try to address mandated cost increases in a manner that does not threaten our ability to ensure the long-term viability of our auditing mission. We take ‘leading-by-example’ very seriously.

One of the first tasks I undertook after assuming office was to change the way the Department budgets. Instead of doing a year-to-year plan, we instead created a four-year budget plan to ensure we would be able to sustain our operations in spite of potential budgetary challenges. This helped us identify a number of areas where we could reduce our own costs and reallocate those savings to other areas of our operation.

We have made great progress internally, generating savings of $2.87 million. This is a remarkable accomplishment because, as many of you know, the nature of our work is extremely labor intensive — as I said earlier, more than 95 percent of our general government operations budget is for personnel costs.

These savings were accomplished by increasing the efficiency of our operation, including:

• Cutting the fleet of state-owned vehicles by more than 94 percent, going from 241 cars in 2013 to just 14 today, and reducing other travel and transportation costs;

• Migrating the Department’s human resources, purchasing and financial operations to the Commonwealth’s SAP system;

• Eliminating much of the Department’s leased office space and parking leases; and

• Shifting the Department’s printing operations to other existing commonwealth printing resources.

AUDITS

In addition to generating internal cost savings, our streamlined processes and procedures enable us to produce audits that are more timely, and with fewer staff. In fact, we are producing audits at a faster rate than any other three-year time period in the agency’s recent history. This is a direct result of modernizing our technology infrastructure through the use of additional IT funding granted to the Department by the General Assembly, as well as by restructuring our operations to best utilize resources and our current workforce.

What’s more, since January 2013, we identified in excess of $322 million in misspent or potentially recoverable state funds through our audits of school entities, municipal pension plans, liquid fuels, corporate tax returns, volunteer firefighter relief associations, and other programs. Some examples include:

• Pointing out improper charter school lease reimbursements;

• Highlighting Scranton’s pension woes and, by following our recommendations, city officials there are improving its financial situation;

• Identifying excess payments for liquid fuels refunds;

• Calling out school bus transportation excessive expenditures and overpayments, school district wasteful spending, and school board governance failures — including saving residents of the School District of Pittsburgh from a tax increase; and

• Uncovering unauthorized or undocumented expenses by volunteer firefighter relief associations.

SOME OF THE BIGGEST IMPACTS ARE NOT FINANCIAL

Our audits are making a difference, and not all audit impacts are financial. We released several major program performance audits or special reports that:

• Helped save children’s lives by bringing about positive changes at ChildLine, the state’s child-abuse hotline;

• Protected seniors who use PACE/PACENET and helped improve the quality of care in nursing and veterans homes;

• Pushed repeatedly to improve Pennsylvania’s charter school law, which is the worst charter school law in the nation;

• Identified areas causing the backlog of untested rape kits and recommended legislative changes to get kits tested in a timely manner;

• Sounded the alarm on the turnpike commission, which is relying on unrealistic revenue projections that will affect travel, and public transit agencies, across the state in the very near future;

• Discovered the Department of Human Services was paying benefits to deceased recipients;

• Offered numerous recommendations for the Department of Environmental Protection to improve its protection of water quality from shale gas development;

• Found out why home care workers weren’t getting paid on time in 2013;

• Recommended changes to resolve a dispute between the city and the Pittsburgh Intergovernmental Cooperation Authority; and

• Led the charge on municipal pension reform.

MUNICIPAL PENSION REPORTING PROGRAM

Speaking of municipal pensions, Act 100, passed during last year’s budget season, made a change to the commonwealth’s reporting and monitoring the state’s municipal pension systems. The Act dissolved the Public Employee Retirement Commission (PERC) and transferred certain responsibilities to my Department and the Independent Fiscal Office.

The Fiscal office now handles the actuarial and legislative functions of PERC. My Department absorbed the three PERC employees into the newly created Municipal Pension Reporting Program to handle all other functions of the former commission. Our transition was seamless, ensuring that state municipal pension and volunteer firefighter relief association funding was distributed on time last fall. We also maintained the reporting requirements of the law by releasing the biannual municipal pension report to the General Assembly last December. Additionally, my Department is working to modernize the reporting process, including eliminating cumbersome paper submissions and moving the entire reporting process online to save municipalities and the commonwealth both time and resources.

LOOKING FORWARD

In my second term, I plan to focus performance audits on these broad areas:

• Effectiveness of drug rehab programs;

• Ensuring state and county offices protect children;

• College affordability;

• Job retraining;

• Economic issues for seniors;

• Infrastructure improvements; and

• Encouraging the commonwealth to identify and allocate funding necessary to fully eliminate the backlog of untested rape kits.

IN CONCLUSION

Chairman Browne, Chairman Hughes, and members of the committee, this is simply a snapshot our efforts at the Department of the Auditor General. Please be assured, we will continue to lead by example. We submit this request in order to maintain the quality and quantity of our audit production to make government better for the taxpayers we all serve. I thank you for the opportunity to appear before you today.

I am pleased to answer any questions.

# # #

EDITOR’S NOTES:

• The Auditor General’s hearing before the House Appropriations Committee is scheduled for Thursday, Feb. 23 at 11 a.m. in room 140 of Capitol building.

• A copy of the Department of the Auditor General’s “Progress Report 2013-2016” is available online at: www.PaAuditor.gov.

• Graphics showing details of the internal cost savings and state funding identified in audits are available online at: www.paauditor.gov/transparency-and-impact

Return to search results