Auditor General DePasquale to General Assembly: Fix Unconstitutional Gaming Act Provision That Could Threaten Funding to Municipalities

Says inaction could be devastating to many communities, residents

Auditor General DePasquale to General Assembly: Fix Unconstitutional Gaming Act Provision That Could Threaten Funding to Municipalities

Says inaction could be devastating to many communities, residents

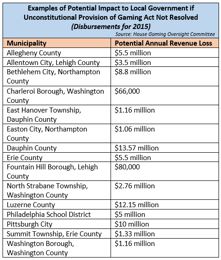

HARRISBURG (Oct. 17, 2016) – Auditor General Eugene DePasquale today urged the General Assembly to swiftly pass changes to the Pennsylvania Racehorse Development and Gaming Control Act to resolve constitutional issues with the so-called “local share assessment” that could cost local governments $140 million a year and endanger services to residents.

The state Supreme Court recently ruled unconstitutional the local share assessment provision of the gaming act. The provision requires casinos to pay to local municipalities 2 percent of slot machine revenues, or a minimum of $10 million a year. The justices ruled that the provision violated the tax uniformity clause of the Pennsylvania Constitution. The court issued a 120-day stay to enable the General Assembly to correct the act’s unconstitutional provision.

“Many counties, cities, boroughs and townships rely on these casino funds to shore up tight budgets for road and bridge maintenance, fire protection, police cars, libraries, debt service and other public service projects,” DePasquale said. “Many of these communities are already burdened by huge municipal pension obligations, so it would be total financial devastation for many of these local governments and their residents to lose their promised share of gaming funds.”

DePasquale said failure by the legislature to correct the local share assessment provision could be devastating for large and small municipalities.

For example, although Fountain Hill, Lehigh County, received a relatively minimal $80,000 in local government share from the gaming act in 2016, the unique circumstances of this municipality heighten the effects of the potential loss of this money.

Fountain Hill is less than one square mile, and home to St. Luke’s Hospital, a world-class, Level-I trauma hospital that is also property tax-exempt due to its non-profit status. Bethlehem Sands Casino is less than two miles from the hospital, which provides emergency room services to an estimated 1,000 patients from the casino last year.

Fountain Hill police and volunteer firefighters must respond to all calls from the hospital, which in 2015 included 590 police calls and 77 fire calls, nearly half of all fire responses in the borough. The borough also pays for snow removal so ambulances can access the hospital, and one snow removal earlier this year cost the borough $26,000.

Potential loss of gaming revenue also presents challenges for the City of Pittsburgh. Mayor Bill Peduto’s office predicts that such a loss of funding would force the city to:

• cancel one firefighter and two police recruitment classes;

• eliminate 20 emergency medical technicians;

• cut 25 percent of the city's public works operations staff; and

• restructure pension funding; the city's Intergovernmental Cooperation Authority, which disburses the gaming funds, has at times earmarked them for the pension fund.

“For communities like Fountain Hill and Pittsburgh and so many others across the state, the General Assembly must urgently act on this vital issue,” DePasquale said. “If there is one thing that the legislature must do in the coming five days this is it: fix this provision of the gaming act, and prevent our communities from potentially life-altering budget cutting decisions.”

# # #